Trusted tax guidance from an Enrolled Agent—serving East Texas and clients nationwide

About McMullen Tax Services in Palestine, Texas

Who We Are

Focus Your Time and Efforts on Running Your Business and Leave the Accounting to Us

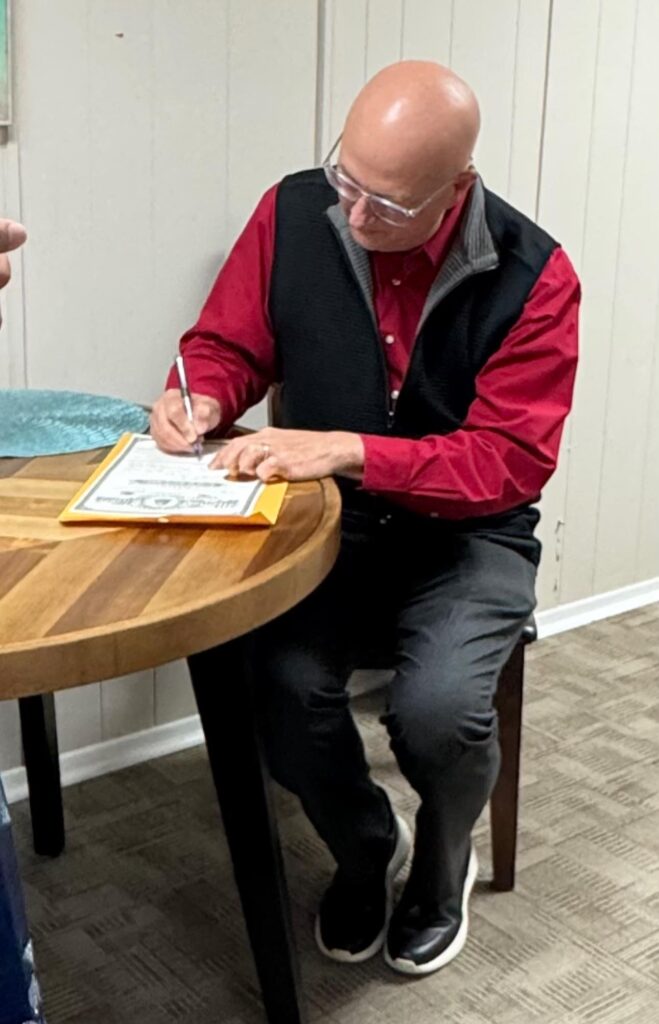

McMullen Tax Services is a husband-and-wife–led practice based in Palestine, Texas. The firm is led by John Wisener, Enrolled Agent (EA)—the only federally authorized tax credential that permits full representation of taxpayers in all 50 states. For more than 40 years, John has helped individuals, families, churches, ministries, and businesses file accurately, plan ahead, and resolve IRS issues with clarity and integrity. He’s known locally as the “Tax Doctor” for his habit of diagnosing the real problem, explaining options in plain English, and building durable solutions—not one-season fixes.

Meet The Team

Brenda Romine Gallup is a dedicated professional with over 40 years of experience in customer service. She spent 35 years working for a financial corporation and later continued her career in banking for more than five years. Guided by her strong faith, Brenda places God at the center of her life and strives to live with kindness and integrity every day. Her greatest joy comes from spending time with her family, especially her grandchild, with whom she is deeply involved. In her free time, she enjoys attending concerts with her best friend and making lasting memories through shared experiences.

My name is Keturah Wilbourn, though most people know me as Kitty. I’m the wife of nearly 20 years to a local associate pastor and the proud mother of four children, whom I’ve had the joy of homeschooling—our oldest just recently graduated. Over the years, I’ve worked in government and have been actively involved in supporting elections for nearly 18 years. I also helped start our local American Heritage Girls (AHG) troop, serving both as treasurer and unit lead for 3 years. I’m QuickBooks certified and currently working toward becoming a Certified Public Bookkeeper, combining my love of organization and community service. When Im not serving my family or community, I enjoy being outdoors, reading, homesteading, crocheting, and doing needlepoint.

Zoey Faith is a fresh graduate, a newly wed and the newest member of the McMullen Tax Service team. She is an assistant youth leader at Holy Ground Worship Center and is the eldest sister of four crazy siblings. She loves community service, which she put to good use this passion by being an American Heritage Girl in troop Palestine TX 1846, for four years. She is a diligent and thoughtful worker, and in her free time, when she is not helping organize and plan community events, she spends time with her family and friends, paddleboarding, and watching cult classic movies.

Erica Ledesma is a dedicated professional with over 13 years of experience in banking and in the past 3 years, in bookkeeping and tax services. Known for her excellent customer service skills, she takes pride in helping clients with care and precision. Outside of work, Erica enjoys spending time with her husband and 2 children, listening to music, doing puzzles, and learning new things. She values family, good food, and continuous growth both personally and professionally.

My name is Barbara Keepers. I am a bookkeeper and tax preparer at McMullen Tax Service. I have over 35 years of experience in accounting, and I assist clients with bookkeeping, payroll, sales tax filing, and financial reporting. I am experienced in QuickBooks desktop and online versions. I also do tax return preparation, and have Annual Filing Season Program certification from the Internal Revenue Service.

On my time off, I enjoy spending time with my family, attending church, reading, and going to the movies. I love to travel, and have many places on my bucket list!

Accounting Services

Our Story & Background

How We Work

Our process is straightforward and transparent:

Discovery & Intake: We review your prior return, current documents, and goals.

Line-by-Line Review: We explain what affects your refund or tax due and identify missed opportunities.

File & Defend: Returns are e-filed with confirmations; if the IRS has questions, we handle them.

Plan Ahead: We adjust withholdings, estimates, and timing to reduce surprises next year.

We communicate on your terms—phone, text, and Instagram—and John returns calls. Taxes don’t stop after April 15, and neither do we.

Who We Serve

While we’re proudly based in Palestine, we support clients across East Texas—including Tyler, Jacksonville, Athens, Crockett, Corsicana, Lufkin, Nacogdoches, Longview, and Huntsville—and represent taxpayers nationwide. We’re a strong fit for families, churches and ministries, organized, established businesses, new workforce entrants, and agricultural operations.

Careers at McMullen Tax Services

We keep a small, focused team and value professionalism, accuracy, and calm under pressure. If you’re an experienced tax preparer, bookkeeper, or payroll specialist who believes in documentation, ethics, and client education—and you’re comfortable supporting clergy or ag clients—introduce yourself. We review interest year-round (seasonal and part-time inquiries welcome).

Our Values

We build every return from the source documents up—no shortcuts, no guessing. If a number isn’t supported, we don’t use it. You’ll see exactly how each figure is calculated so your return is both accurate and defensible.

Individual return prep starts at $185; final pricing is based on forms and complexity. Quotes for preparation work are free. Advisory deposits are $100 for individuals and $200 for businesses, and they’re credited to your project if you move forward—no surprise charges, ever.

We explain what we file and why, in plain language. Expect a quick walkthrough of key lines, credits, and deductions so you can make smarter decisions on withholdings, estimates, and timing next year.

As an Enrolled Agent, John can represent you directly before the IRS in all 50 states. We handle notices, calls, and documentation, keep deadlines on track, and communicate status clearly so you’re never guessing about next steps.

We prepare student returns at no charge and provide financial-literacy sessions for local schools and groups. It’s our way of building confident, long-term relationships with families across East Texas.

Clergy & Agriculture

A Note on Special Expertise

Clergy compensation and housing allowance have unique rules and pitfalls—John’s 25+ years in ministry mean those details aren’t an afterthought. Likewise, agricultural clients face seasonal cash flow, equipment timing, and depreciation choices that can materially change outcomes. We build plans that reflect the work you actually do. We’re rooted in the community as active members of the Palestine Chamber and local ambassador programs. John regularly presents tax and financial-literacy sessions to area high schools and prepares student returns for free, building trust with young adults as they enter the workforce and establishing multi-generational relationships with their families.

Call the Tax Doctor Before You Decide

A five-minute call today can prevent a five-figure mistake at filing time. Whether you’re weighing a vehicle or equipment purchase, adjusting benefits, considering real estate, or staring at an IRS letter, talk to us first.

Call or email McMullen Tax Services to start your return, request representation, or schedule a mid-year planning session that pays off when it counts.